Promotion of Community-based Financial Services

Promotion of Community-based Financial Services

We promote community-based financial services through the following activities based on the basic policy of “contributing to revitalization of local economies by strengthening the financial intermediary function.” In addition, we distribute information on the details and achievements of these efforts through news releases and our website.

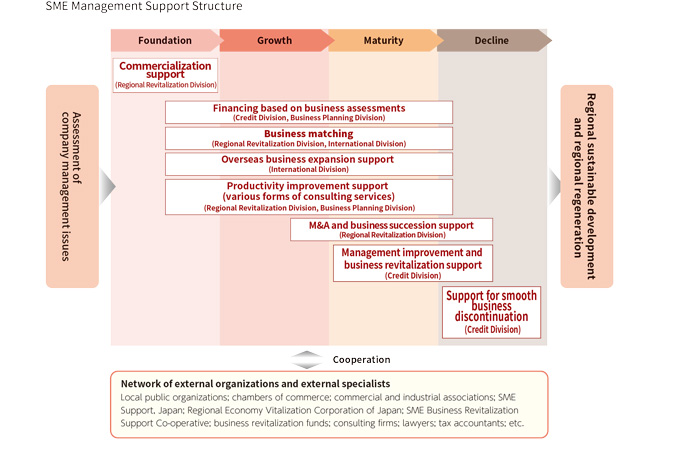

1. Exert consulting functions in accordance with the life stage of local businesses

We conduct various support activities in accordance with the life stage of clients including commercialization support, financing based on business assessments, overseas business expansion support, M&A and business succession support, as well as management improvement and business revitalization support.

2. Active participation in local wide-region revitalization

We work to contribute to the region through means such as grass-rooted industry support and PFI promotion.

3. Active involvement in projects on revitalization of local economies

The entire Bank has strengthened ties with local public organizations and is actively involved in projects on revitalization of local economies in order to resolve issues related to revitalization of local economies.

Status of Achievement of Numerical Targets Stipulated in the “Community-Based Finance Promotion Plan for the Fiscal Year Ended March 31, 2017”

| Area of activity | Target item | Target | Results |

|---|---|---|---|

| Exert consulting function in accordance with the life stage of local businesses | Number of foundation and new business support provided | 20 | 31 |

| Number of new hospital and nursing care business support provided | 100 | 147 | |

| Number of new business succession consultations | 70 | 70 | |

| Number of new M&A consultations | 130 | 275 | |

| Number of business fairs held | 6 | 8 | |

| Number of overseas business expansion support provided | 300 | 508 | |

| Active participation in local wide-region revitalization | Number of agriculture, forestry & fisheries industry business support provided | 10 | 18 |

| Number of tourism industry business support provided | 4 | 4 |

*Please refer to the Bank’s website for specific contents and results of the Community-Based Finance Promotion Plan.

Specific Initiatives

Support for customers aiming to establish or develop a new business

Signing of the Agreement on Promotion of Regional Revitalization through Foundation Support with Shima City

In March 2017, the Bank signed the Agreement on Promotion of Regional Revitalization through Foundation Support with Shima City.

The purpose of the agreement is to promote revitalization and activation of local economies in Shima City through providing support for start-ups and business expansion in cooperation with Shima City to customers starting or expanding a business in Shima City.

The Bank will contribute to revitalization and activation of local economies in Shima City through partnerships to support customers starting or expanding a business and by holding various kinds of seminars and business fairs.

Support for customers aiming to make a leap forward in the growth phase

Support for sales channel expansion utilizing crowdfunding

The Bank is promoting business alliances with external institutions in order to support the diverse needs of our customers. In partnership with CyberAgent Crowd Funding, Inc., we posted a total of four projects on the crowdfunding service Makuake during the fiscal year ended March 31, 2017. This online service lists new products along with the story behind product development to gather funds from individuals who are eager to support the products. It is attracting attention as a new sales route since it enables test marketing,

accumulation of track records, and provides means for funding new products. We will continue to work together with partners that match the needs of customers in order to support business growth of our customers.

Support for customers that require management improvement, business revitalization, and changes in business activities

Business revitalization support through the utilization of revitalization funds

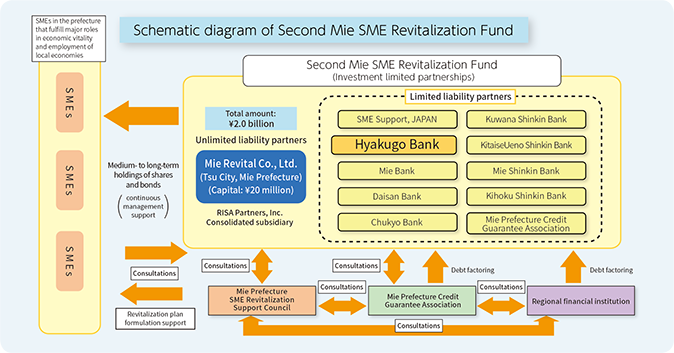

As part of efforts towards the rehabilitation of local SMEs and the activation of local economies, following the legacy of the Mie SME Revitalization Fund (established June 2013, business revitalization support provided to nine companies) that was established jointly with financial institutions, etc. in Mie Prefecture as a public and private integrated fund, the Second Mie SME Revitalization Fund was established in April 2016. By using this fund, business revitalization support was provided to three companies in the fiscal year ended March 31, 2017. Going forward, we will utilize this fund to work towards the activation of local economies through the rehabilitation of the business of local SMEs.

Support for customers with business succession needs

Holding of M&A seminars and increasing the number of M&A personnel

In November 2016, the 15th M&A Seminar was held by the Chubu Finance M&A Network*, at which explanations were provided on business succession through M&As centered on talks about actual experiences on business transfers.

As the average age of business owners is increasing every year, there is an increasing need for business succession through M&As due to the lack of successors. The seminar was received with great interest with the participation of around 80 participants mainly consisting of business owners.

In addition, to respond to the growing M&A needs, the Bank substantially increased the number of M&A personnel from four to nine during the fiscal year ended March 31, 2017 to develop a system that can broadly support the needs of local customers.

* Project on revitalization of local economies conducted together with Juroku Bank and the Bank of Nagoya

Efforts towards activation of local economies

Holding of the Sixth Hyakugo Tourism Academy Seminar

For the purpose of contributing to the development of the local tourism industry, we have conducted tourism questionnaires, monitor tours, a seminar called the Hyakugo Tourism Academy, and business fairs since the fiscal year ended March 31, 2014.

In February 2017, we held the Sixth Hyakugo Tourism Academy Seminar and invited photographer Mariko Yamamoto, who is well-known as “Camera Joshi” (camera girl) and has an affiliation with the Kumano Kodo trail, as the lecturer. Ms. Yamamoto talked about topics such as techniques for shooting better photos for posting on websites and SNSs, tips for better communicating information utilizing SNSs, and how to increase the number of followers. The seminar was well-received by participants with practical and easy-to-understand lectures that included on-site experience of handling a camera.

Signing of the Comprehensive Partnership Agreement Concerning Work Style Reform with the Mie Labor Bureau.

The Comprehensive Partnership Agreement Concerning Work Style Reform was signed with the Mie Labor Bureau for the purpose of promoting “work style reform” that contributes to revitalization of local economies in Mie Prefecture.

Through the conclusion of this agreement, both parties will work closely together to promote “work style reform” in Mie Prefecture and to improve productivity of businesses through promotion of the utilization of subsidy systems in an aim to revitalize local economies.

Specifically, we are considering joint holding of a seminar on the theme of “work style reform” in order to communicate information on this topic to businesses in Mie prefecture.