Message from the President

An Overview of “Next COMPASS 140” (April 2016 - March 2019)

■Three points of focus

Innovation in the ways of working

Topline innovation

Supporting and growing together with the regions

■ Targets and business performance for the fiscal year ended March 31, 2019

| Item | Target | Business performance |

| Average balance of deposits (including NCDs) | ¥5,190 billion or more | ¥4,992.9 billion |

| Average balance of loans | ¥3,150 billion or more | ¥3,246.2 billion |

| Ending balance of investment trusts (total for Hyakugo Bank and Hyakugo Securities) |

¥300 billion or more | ¥135.5 billion |

| Net income | ¥6.5 billion or more | ¥10.7 billion |

| ROE (shareholders’ equity base) | 2.7% or more | 4.32% |

Looking back at the previous medium-term management plan

■Innovation in the ways of working

In our innovation in the ways of working, we launched the Kaeru Project at the start of the previous medium-term management plan, supporting diverse work styles and improving productivity.

Specifically, we introduced a telework system, extended the duration of childcare leave, increased work hour flexibility, and implemented other measures with the goal of building a flexible working environment with more options. We have succeeded in firmly establishing work styles that produce results in a limited time by working to raise the awareness of employees and by identifying and steadily addressing issues in individual divisions. Through these activities, we have created worker-friendly and highly productive working environment.

Going forward, we will enhance our activities from the perspective of promoting diversity and create an organization that creates new value, in which diverse personnel feel greater motivation and job satisfaction.

■ Topline innovation

In our topline innovation, we have worked to rebuild our loan portfolios. Specifically, our average balance of loans exceeded our targets due to our enhancement of our loans for middle-scale enterprises as well as small and medium-sized enterprises and housing loans in our home base of Mie Prefecture and Aichi Prefecture. In Aichi Prefecture, in particular, we opened the Ichinomiya Branch and Moriyama Branch, achieving our medium- and long-term loan balance target of one trillion yen ahead of schedule.

In order to create a stable profit base that is unswayed by the interest rate environment, we also strove to increase fees and commissions. Due in part to the future uncertainty of the market, our balance of investment trusts fell below the target, but our fees and commissions on housing loans were strong, and our overall fees and commissions surpassed the targets.

■ Supporting and growing together with the regions

We carried out various initiatives in order to grow together with the regions by contributing to solving the issues they faced.

The number of small and medium-sized enterprises in Mie Prefecture has continued to fall, and the number of businesses closing down, being suspended, or being dissolved for reasons such as the inability to find a successor is now 4.8 times the number of businesses that closed due to bankruptcy. Business succession has become a pressing issue. To tackle this issue, we have assigned 14 staff in charge (an increase of seven staff in charge) and enhanced our business succession and M&A support. Thanks to the considerate, comprehensive support we offer in collaboration with our branches and headquarters, we have raised the number of support cases, providing assistance to over 800 enterprises in the fiscal year ended March 31, 2019.

Furthermore, to support the digitalization of local businesses, we held the “105 Digital Forum” on November 19, 2018, the 140th anniversary of our founding. In addition, a large number of our customers used the Hyakugo Charitable Private Bond “Yume-No-Chikara,” which donates books, equipment, and other items to educational institutions or other organizations designated by issuers. Through such initiatives, we strove to increase the value of local businesses and collaborated in social contribution activities.

The Long-term Vision of the “the Digital & Consulting Bank that Opens Up the Future to Customers and the Region” and Five Future Goals

Our long-term vision and the position of our new medium-term management plan

■ Long-term vision (future ideals)

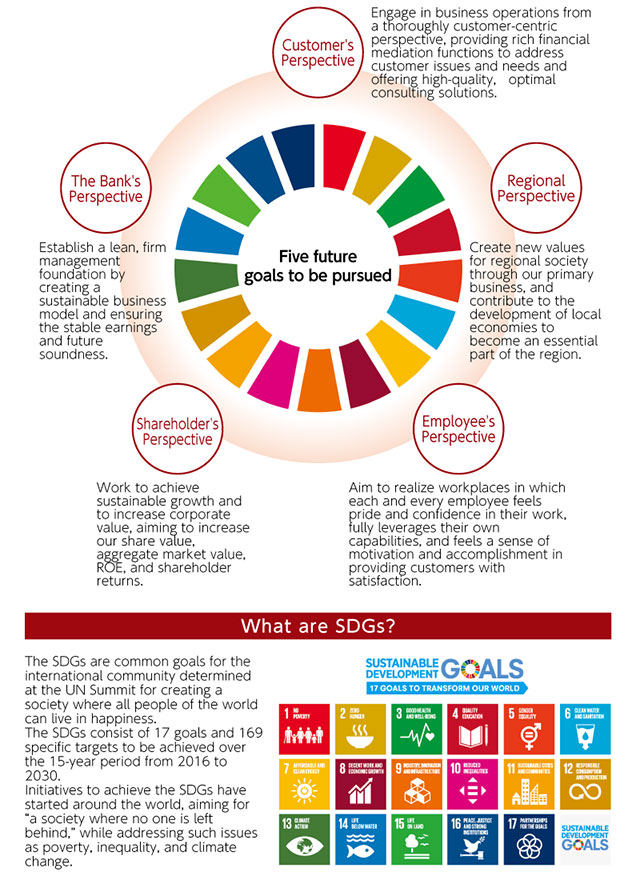

Amidst concerns over diminishing earnings from our conventional business model of deposit/loan expansion, customer issues and needs are becoming more diverse and severe. We believe that our future ideal is one of providing high-quality, optimal products, services, and solutions (problem solving) to differentiate ourselves from our competitors and become our customers’ most trusted partner.

In response to the growing tide of digital innovation, we must provide our customers with greater convenience by creating next-generation branches and digitizing bank operations and customer procedures, dramatically reduce costs, and implement new non-face-to-face channels for young customers and other members of the digital generation.

By fusing these real-world (face-to-face business, consulting, store operations, etc.) and digital (non-face-to-face channels, etc.) measures, we will meet the changing faces of society and create shared value with our customers and regions. Through this, we seek to achieve sustainable and stable growth.

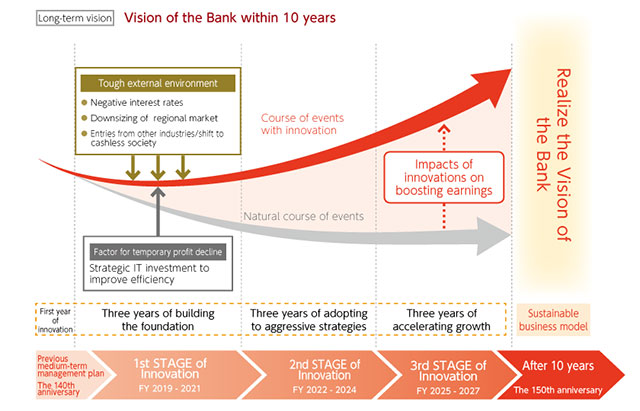

■ The position of our new medium-term management plan

Our new medium-term management plan is the first step in the innovations we are implementing with our eyes set on “Digital & Consulting Bank,” our ideal for 10 years from now, when we celebrate the 150th anniversary of our founding.

The new medium-term management plan consists of three years of foundation building across every area of business, aimed at this vision for 10 years into the future. We cannot achieve sustainable growth with a shaky foundation, so we will not seek short-term results, but instead carry out innovations from a medium- and long-term perspective.

ESG and SDGs initiatives

- Working to create a sustainable future -

We consider deepening understanding of ESG and SDGs and incorporating them into our operations to be essential elements in aiming at our long-term vision and the five future goals. Based on such perspective, our policy is to link all of the basic strategies of our new medium-term management plan to the ESG and SDGs goal of achieving a sustainable society, and we further increase our corporate value.

In our ESG and SDGs promotion activities, we believe that it is important that we not take a short-term perspective, but instead that we engage in anticipatory investment aimed at sustainable value creation from a long-term perspective, and that our entire organization shares the same common understanding as we carry out these activities. This is why we have established an “SDGs Promotion Committee,” with the Corporate Planning Division as its supervising division, and follow a policy of sharing a Bank-wide awareness of ESG and SDGs issues and implementing concrete initiatives aimed at tackling these issues.

Under the new medium-term management plan, the “Public Relations & CSR Section” has been renamed the “Public Relations & ESG Section.” With more enhanced information dissemination about our ESG and SDGs initiatives, we will make efforts to earn a high level of trust from various stakeholders, such as investors, members of the community, and customers, and further increase our corporate value.

KAI-KAKU 150 1st STAGE “Gateway to the Future”

- Aiming to Transform into a Digital & Consulting Bank -

An overview of the New Medium-term Management Plan

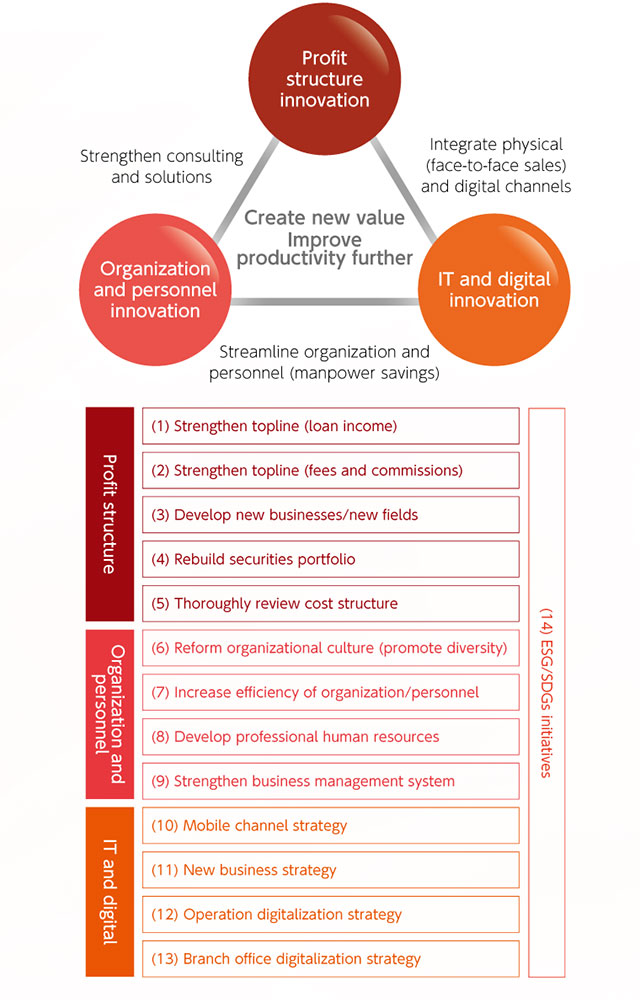

The new medium-term management plan implements innovation in three areas, “profit structure innovation,” “organization and personnel innovation,” and “IT and digital innovation,” in view of the environment surrounding the Bank and the issues it faces, and creates the foundation for realizing the Bank’s long-term vision of “the Digital & consulting bank that opens up the future to customers and the region.” Below are the key strategies related to each of these innovations.

■ Theme

■ Three innovations and 14 basic strategies

■ Numerical targets (Year ending March 31, 2022)

・Net income ¥10 billion or more

・ROE (shareholders’ equity base) 3.7% or more

・OHR (core business gross income base) less than 79%

・Capital adequacy ratio 9.5% or more

・Average balance of deposits (including NCDs) ¥5,230 billion or more

・Average balance of loans ¥3,700 billion or more

・Loan-deposit-ratio (average balance base) 70% or more

■ Profit structure innovation

We will fully leverage our financial mediation functions to address the issues and needs of customers and will provide consulting and solutions optimally tailored to customers to reinforce our loan income and fees and commissions.

In order to achieve this, we have newly established a “Solution Business Division” that aggregates our separate headquarters business divisions, and drastically increased the number of corporate financial advisors (FAs), who serve as bridges connecting branches with the Division, from four to 14. Through this, we are working to improve coordination between branches and our headquarters, group companies, and external institutions, and to raise our consulting proposal level. Furthermore, by improving the efficiency of our business activities, we will increase the amount of time that can be spent for holding dialogues with customers, contributing to the resolving of customer issues.

■ Organization and personnel innovation

We will deepen our ongoing reform of the work style while also promoting diversity. Through this, we will enable all of our personnel to leverage their full capabilities and create workplaces in which employees feel motivation and job satisfaction. To achieve this, we have renamed the Corporate Planning Division’s “Work Style Reform Promotion Office” while also elevating it from “Office” to “Division” level, creating the “Diversity Management Division.” This Division will actively promote the participation of women and support their self-directed career formation, and also promote the participation of the elderly in the workplace.

We will also enhance our training system and promote self-development, nurturing professional personnel with a mastery of consulting.

In addition, by improving the level of our measures for Anti-Money Laundering and Counter Financing of Terrorism as well as our compliance system, we will build a solid business management system.

■ IT and digital innovation

In order to deploy evolving digital technologies, optimize entire systems, and promote medium- and long-term digital strategies, we have newly established a “Digital Innovation Division.”

Our IT and digital innovation begins with our digitalization of customer contact points. Our customers’ lifestyles are changing with advances in digital technologies and the growing ubiquity of smartphones. As there is a growing need, especially among younger customers, to handle all bank transactions and procedures “via smartphone anywhere, at any time,” we will meet this need without delay.

In the meantime, we will also advance the digitalization of operations within the Bank. As digital technologies evolve day by day, we can skillfully integrate these digital technologies to contribute to drastic improvements to the quality and efficiency of bank operations. The Digital Innovation Division will therefore take the lead in investigating new technologies and deliberating on comprehensive policies for using them in operations. It will promote IT and digital innovation in order to bring about overall optimization.

Going forward, Hyakugo Bank will live up to the trust placed in us and all executives and employees will work together to ensure development of the regional society and the Bank. We appreciate your further support and cooperation.